jersey city property tax rate 2020

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year.

Property Taxes Calculating State Differences How To Pay

The average effective property tax rate in New Jersey is 240 which is significantly higher than the national average of 119.

. The Average Effective Property Tax Rate in NJ is 274. The General Tax Rate is a multiplier for use in determining the amount of tax levied upon each property. Online Inquiry Payment.

New Jersey New Hampshire Illinois have highest property tax rates National. 6757 hqhudo 7d 5dwhiihfwlyh 7d 5dwh 621 7 717 7 7 5171 7 81 252 81 967 73. General Tax Rates by County and Municipality.

In New Jersey localities can give. The property tax rate is 4548 for each 1000 of assessed value. Jersey city property tax rate 2020.

Assessed Value 150000 x General Tax Rate 03758 Tax Bill 5637 Disclaimer. Senin 10 Januari 2022. City of Jersey City.

Studying in Australia immigration consultants in Chandigarh. The average 2020 New Jersey property tax bill was 8893 an increase of 157 vs. Lawsuit Alleges Developer of NJs Tallest Building is Defrauding Condo Purchasers 124 Residences Event Space and New School Planned for Jersey Citys Sacred Heart Site Jersey Citys Broa Moving to Historic House on Grove Street.

The Garden State is home to the highest levies on property in the nation with a mean effective property tax rate of 221 according to the Tax Foundation. Assessed Value 150000 x General Tax Rate 03758 Tax Bill 5637. While Cape May County has the lowest property tax.

This rate is used to compute the tax bill. When combined with relatively high statewide property values the average property tax payment in New Jersey is over 8400. Home Unlabelled Jersey City Property Tax Rate 2020 - Analysis.

Illinois 173 7 Several states implemented corporate income tax rate. Example General Tax Rate. Check spelling or type a new query.

Jersey city property tax rate 2020 Friday February 25 2022 Edit. New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes. GMAT coaching in ChandigarhPunjab Read More.

Dont let the high property taxes scare you away from buying a home in New Jersey. ARP aid expires in 2024. Jersey City was allocated 146 million in total ARP aid.

You can contact the city of hoboken assessor for. For comparison the median home value in new jersey is 34830000. Example General Tax Rate.

Portions of jersey city are part of the urban enterprise zone. 587 rows County 2021 Average County Tax Rate 2020 Average County Tax Bill. 10292020 TAXES PAYMENT 000 173326 000 0 000.

Jersey Citys 148 property tax rate remains a bargain at least in the Garden State. Jersey city property tax rate 2020 Read More. Shore Vacation Rental Owner Testimonial Video In 2020 Testimonials Vacation Rental Rental Pin On Wall St Veteran What Are Bad Banks Why India Is Moving Towards It Diy Projects For Beginners Fun Hobbies Finance Plan.

11604 00001 Principal. Property Tax Rates Average Residential Tax Bill for Each New Jersey Town The average 2020 Hudson County property tax bill was 8353 an increase of 159 from 2019. 78 million of that amount is included in the 2021 budget compared to 28 million of federal COVID-19 in 2020.

What is the Average Property Tax Rate in NJ. Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. Property tax rates are the rate used to determine how much property tax you pay based on the assessed value of your property.

It is expressed as 1 per 100 of taxable assessed value. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records. Jersey city property tax rate 2020 Friday February 25 2022 Edit.

The average effective property tax rate in New Jersey is 242 compared with a national average of 107. The City of Newark New Jersey Tax Lien Sale will be held via the Internet 12312020. It is expressed as 1 per 100 of taxable assessed value.

2 days agoAccording to the Education Law Center Jersey Citys local fair share is about 532 million. POSSIBLE REASONS BEHIND STUDENT VISA REJECTION Read More. Camden County has the highest property tax rate in NJ with an effective property tax rate of 391.

Pennsylvania 135 14 Several states implemented corporate income tax rate changes over the past year among other revisions and reforms. According to the ELC the local tax levy for the. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year.

Jersey city property tax rate 2020 Read More.

Percent Of U S Owner Occupied Housing Value 500k Vivid Maps Percents Vivid Owners

Good Comparison Of The House Vs Senate Tax Bills Tax Deductions Senate Bills

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Homeowners Property Taxes Grew Faster During Pandemic

Alameda County Ca Property Tax Calculator Smartasset

Pros And Cons Of Living In An Area With Low Property Taxes Gobankingrates

Property Taxes How Much Are They In Different States Across The Us

Property Tax How To Calculate Local Considerations

Countries With No Property Tax Tax Free Countries

Property Taxes Calculating State Differences How To Pay

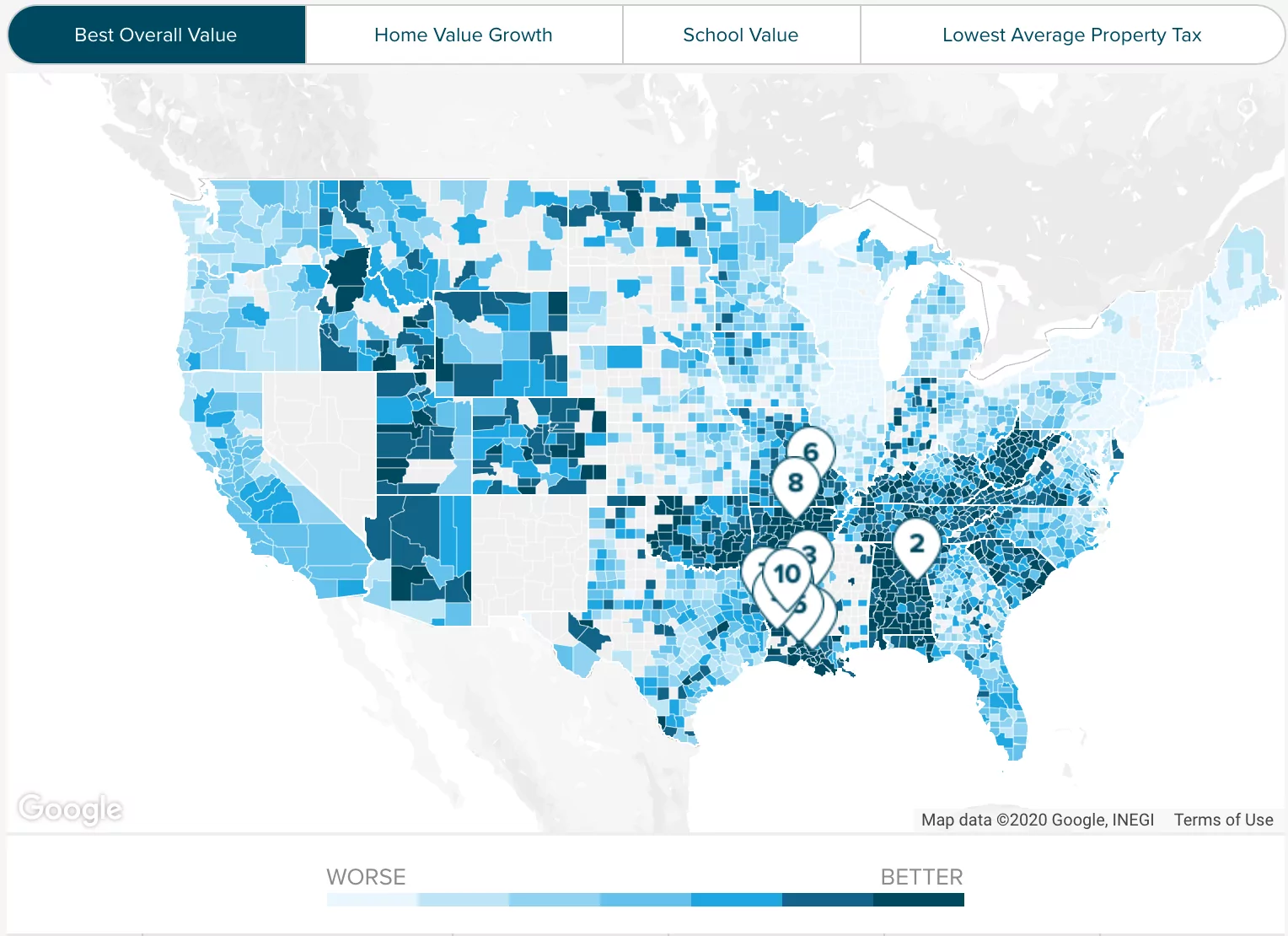

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Why Identical Homes Can Have Different Property Tax Bills Lincoln Institute Of Land Policy

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Pennsylvania Property Tax H R Block

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

State Local Property Tax Collections Per Capita Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)